NPS or New Pension Scheme is a retirement product launched by Government of India. It is managed by PFRDA (Pension Fund Regulatory and Development Authority). This product helps you to create retirement corpus. NPS was launched on 1st Jan 2004 initially it was for the central Govt Employees (Except Armed Forces ).Later NPS was made available for ll the citizens of the country with effect from 1st May 2009

Any citizen of India (whether resident or NRI) can invest in this scheme. The age of the subscriber must be within 18-60 years of age. However, an individual of unsound mind or existing members of NPS are not allowed to open new account. Therefore, an individual can open only ONE NPS account. When you Open NPS Account you have to choose the following

lets understand all the above in Detail

Note : You can change the fund Manager

Note : To Open Tier 2 Account Subscriber should have Tier 1 Account if Tier 1 Account is Closed then Tier 2 will be automatically Closed

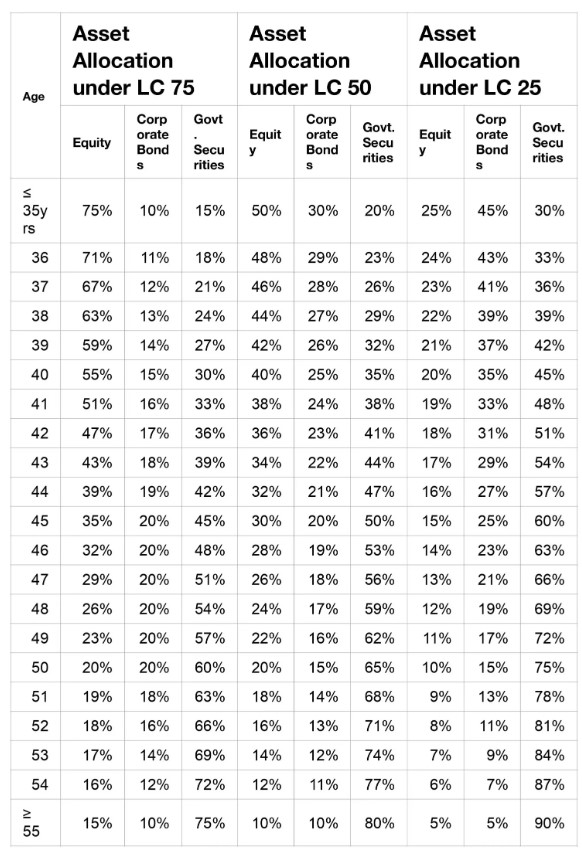

Based on the Option the money is invested in various Asset classes

The Distribution of Money is mentioned Below

Note : 1. Reallocation among the asset classes shall take place on your date of birth every year

2. You may change your preference only twice, at any time during the financial year

There are three options available for subscribers once they reach the age of 60 years.

1. Continuation of NPS account:

The subscriber can continue to contribute to NPS account beyond the age of 60 years/superannuation (Up to 70 years). This contribution beyond 60 is also eligible for exclusive tax benefits under NPS. 2. Deferment (Annuity as well as Lump sum amount):

The subscriber can defer Withdrawal and stay invested in NPS up to 70 years of age. The subscriber can defer only lump-sum Withdrawal, defer the only Annuity or defer both lump sum as well as Annuity. 3. Start your Pension:

If the Subscriber does not wish to continue/defer NPS account, he/she can exit from NPS. He/she can initiate exit requests online and asper NPS exit guidelines start receiving a pension.

NPS EXIT & Withdrawal – TIER 1

After attaining the age of 60 years

Let us now discuss about the exit options available under the NPS once the subscriber reach the age of 60 years.

When a subscriber reaches the age of Superannuation/attaining 60 years of age, he or she will have to use at least 40% of accumulated pension corpus to purchase an annuity that would provide a regular monthly pension from the PFRDA tied up and IRDA approved Life Insurance companies to pay the pension in Mode of Annuity The remaining funds (60%) can be withdrawn as lump sum.

Facility of phased Withdrawal is available for NPS Subscribers. Subscriber can opt for withdrawal of lump-sum amount (60%) in a phased manner (up to 10 instalments) over the period from 60 years (or any other retirement age as prescribed by the employer) to 70 years. However, Subscriber has to buy Annuity prior to Phased Withdrawal (from the mandatory 40%).

Note : However, if the total accumulated pension corpus is less than or equal to Rs. 2 lakh, the Subscriber can opt for 100% lump sum withdrawal.

Before attaining the age of 60 years

If you wish to withdraw before the superannuation age of 60 years, then such exit option is called partial withdrawal. Hence, you are not allowed to withdraw fully. But to certain extent you can withdraw partially. Hence, in this option you are allowed to partially withdraw and continue your NPS account.

You are allowed to withdraw 25% of the accumulated corpus at any time (but excluding contributions made by the employer), as on the date of application of withdrawal. Few points to note are as below.

Note-As per Budget 2017, the subscriber whose NPS account is at least 10 years old will be eligible for withdrawing 25% of his/her contributions (without accrued income earned thereon). This 25% withdrawal will be part of total 40% withdrawal (which is tax-free).

You are not allowed to withdraw the NPS corpus as per your wish. There are certain purposes set by PFRDA. They are as below.

Partial withdrawal request can be initiated online by Subscriber. Alternatively, Subscriber can submit physical partial withdrawal form (601-PW) along with documents to POP, based on which POP can initiate online request.. However, POP is required to ‘Authorize’ the Withdrawal request in CRA system.

As of now, the eligible Subscribers need to submit their application for a partial withdrawal to the respective nodal officers/POPs along with the supporting documents to substantiate the reasons for their request for partial withdrawals.

In order to ease the process of partial withdrawal and make it simple, online and paperless in the interest of Subscribers, it has now been decided to allow the Subscribers to allow partial withdrawal based on ’self-declaration’ and thereby doing away with the submission of supporting documents to substantiate the reasons for partial withdrawal.

To further expedite the process and to ensure timely payment of partially withdrawn amount into the Subscribers’ bank account, the partial withdrawal requests received online shall be directly processed in Central Record Keeping Agency (CRA) system thereby doing away with the authorisation of the request at the level of nodal office/POP.

This Liberalised process is however strengthened by effective due diligence with technology enabled INSTANT BANK ACCOUNT VERIFICATION through penny drop to identify the beneficiary and the Subscriber’s bank account. In order to ensure payment of

amount into correct bank account number and rightful beneficiary, CRAs shall be carrying out ’Instant Bank Account Verification’ through penny drop and the cost of the same shall be borne by the Subscribers.

b) Exit

In case of pre-mature exit (exit before attaining the age of superannuation/attaining 60 years of age) from NPS, at least 80% of the accumulated pension corpus of the Subscriber has to be utilized for purchase of an Annuity that would provide a regularmonthly pension.The remaining funds can be withdrawn as lump sum.However, you can exit from NPS only after completion of 10 years. If the total corpus is less than or equal to Rs. 1 lakh, Subscriber can opt for 100% lump-sum withdrawal.

Tags : ,

W1504, Tower 8 , Sattva Divinity Mysore Road Bangalore 560026

+91 9963760464

Wealth 360 © 2023

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-160301 | Date of initial registration ARN – 23-Sep-2024 | Current validity of ARN – 01-Oct-2027

Grievance Officer- Vikram Aralikatty | vikram.aralikatty@wealth360.co.in

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors